The Financial Sector Reinvents Itself in the Digital Era

Cutting-edge technologies like AI, blockchain, and cloud computing are revolutionising operations, enhancing customer experiences, and shaping the future of finance. Featuring the success story of BPI.The financial industry is witnessing unprecedented technological innovation. In this hyperconnected age, where every second counts and each piece of data holds value, banking institutions are undergoing a digital transformation that is redefining their operations and customer relationships.

The figures are clear: according to recent IDC research, nearly the entire banking sector (98%) plans to embark on digital transformation initiatives within the next three years.

This shift is not merely a trend but a necessary response to an increasingly competitive and demanding environment. Cloud computing, in particular, has become pivotal to this change, with more than half of global financial institutions planning to migrate at least 40% of their operations to cloud environments.

AI as a Catalyst

Artificial intelligence is the driving force behind this new paradigm. Projections from Juniper Research reveal a remarkable forecast: investment in generative AI in the financial sector is expected to surge by over 1,400% by 2030, reaching £67 billion.

This exponential growth is no coincidence; it highlights AI's wide-ranging applications in finance. Real-time fraud detection systems, powered by advanced pattern analysis, have become significantly more effective.

Customer experience has undergone a qualitative leap, with 24/7 service systems—such as chatbots and intelligent virtual assistants—capable of handling both routine queries and complex operations. Meanwhile, the personalisation of financial products and services has reached new heights, enabling institutions to tailor offerings to meet specific customer needs.

Additionally, the automation of operational processes has led to significant cost reductions, while predictive analytics has transformed credit risk assessment, facilitating more precise and informed decision-making.

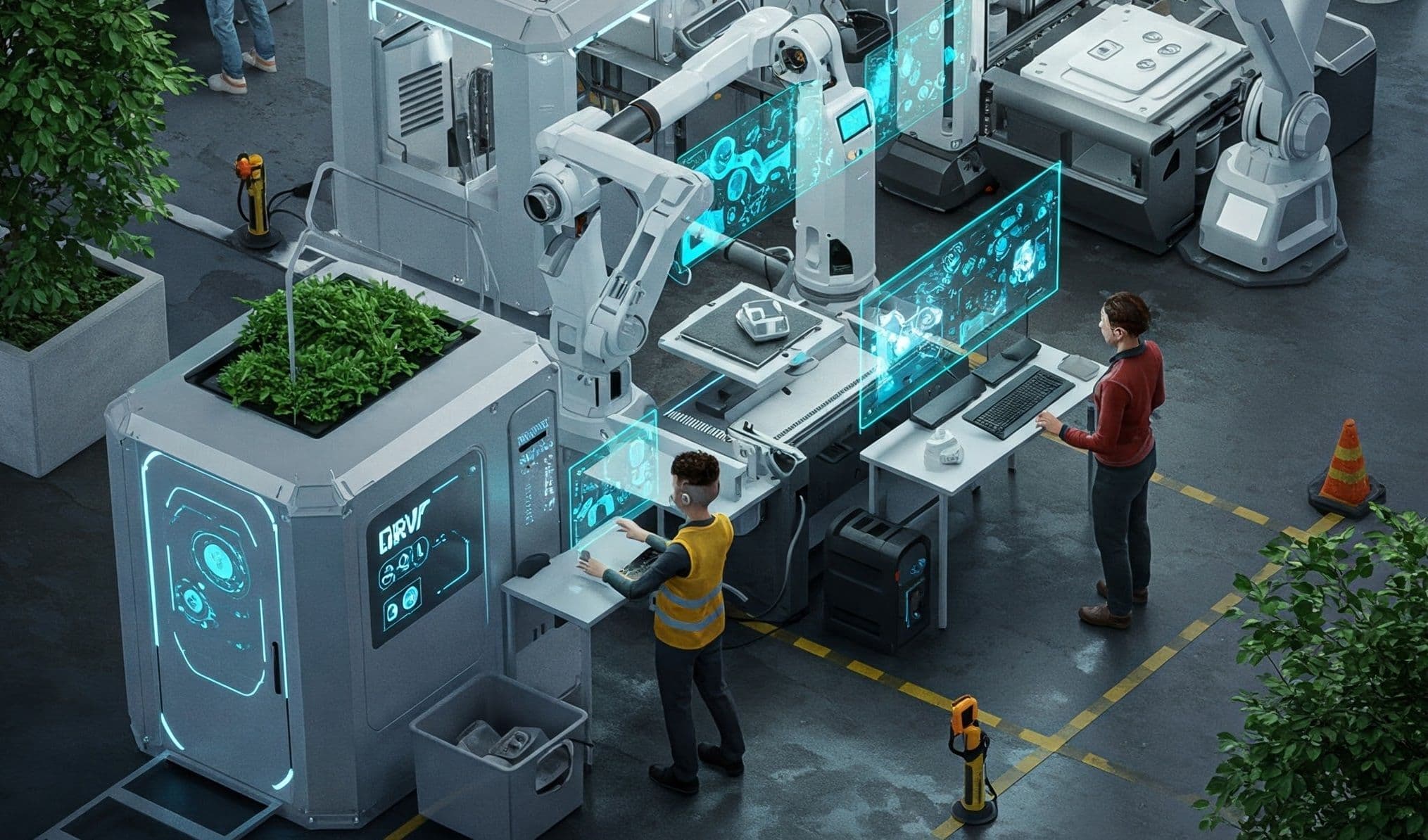

An Emerging Technological Ecosystem

The digital transformation of banking extends well beyond AI. Complementary technologies are fostering a more robust and efficient financial ecosystem:

Blockchain is revolutionising international transactions by eliminating intermediaries and reducing operational costs. Smart contracts automate processes that previously required manual validation, while cryptocurrencies challenge traditional notions of money and value.

The Internet of Things (IoT) is having a particularly significant impact on the insurance sector, enabling more precise risk assessments and the creation of personalised policies based on real-time data.

Cloud computing allows financial institutions to scale operations with flexibility and efficiency. Beyond reducing physical infrastructure costs, it enhances operational agility, improves team collaboration, and bolsters security through advanced cybersecurity solutions.

A Leap into the Future

Modernisation is far from abstract, as exemplified by BPI Financial Group Limited in Singapore. Facing the challenge of upgrading outdated systems to remain competitive in an increasingly demanding global market, BPI turned to SAP Business One, implemented by Axxis Consulting, a United VARs member with extensive experience in similar projects.

The new platform enabled BPI to automate and optimise its accounting and financial operations, particularly in critical areas such as document tracking and the management of international multi-currency transactions.

As BPI Finance Manager Coco Chan remarked: "The implementation not only met technical objectives but did so efficiently and cost-effectively. The result was significantly improved productivity, reduced operational costs, and, most importantly, more agile and efficient customer service".

Beyond Technology

The financial sector's digital transformation is an ongoing journey that extends beyond the mere adoption of new technologies. Financial institutions are recognising that true innovation must focus on customers and the cultivation of lasting trust.

In this evolving paradigm, data protection is as critical as traditional financial soundness. Banks must balance technological innovation with robust security and privacy measures, particularly in the face of increasingly sophisticated cyber threats.

Regulation is also pivotal. Regulatory bodies are adapting frameworks to accommodate emerging technologies while ensuring the stability of the financial system. Concepts such as Open Banking are reshaping how institutions share data and collaborate.

Institutions that fail to adapt to this new landscape risk being left behind in an ever-more competitive market. However, success will not be measured solely by the adoption of advanced technologies but by the ability to leverage them to deliver genuine value to customers.