Green Cryptocurrencies: Sustainable Solutions for a Digital Economy

As digital currencies revolutionise finance, their environmental impact poses an urgent challenge. The rise of green cryptocurrencies promises sustainable transactions through more efficient and eco-friendly technologies.In the world of digital finance, cryptocurrencies have become one of the most transformative technological innovations of the 21st century. From the emergence of Bitcoin in 2009 to today’s diverse ecosystem of digital assets, these decentralised currencies have fundamentally reshaped our understanding of money, value transfer, and financial inclusion.

The appeal of cryptocurrencies lies in their revolutionary approach to transactions. By eliminating intermediaries such as banks and payment processors, they provide users with greater control over their financial assets, enabling near-instantaneous and borderless transfers at a fraction of traditional costs.

Their rapid growth has been remarkable. According to a recent report by Triple-A, the number of cryptocurrency users is projected to reach 562 million in 2024, a 33% increase from the 420 million recorded the previous year. This trajectory highlights not only growing mainstream adoption but also the potential of cryptocurrencies to reshape global financial systems.

The success of cryptocurrencies can be attributed to their decentralised nature, which protects users from government-imposed currency devaluations, the transparency and security offered by blockchain technology, and the democratisation of access to the global economy for billions of unbanked individuals worldwide.

The Environmental Cost

However, this digital financial revolution comes at a significant environmental cost. At the heart of the issue is the energy-intensive process known as "mining", the mechanism through which transactions are verified and new coins are created in many cryptocurrency networks.

This process consumes vast amounts of electricity, much of which comes from non-renewable sources such as coal and natural gas, contributing to an increased global carbon footprint.

Bitcoin, the first and most valuable cryptocurrency, operates using a consensus mechanism known as Proof of Work (PoW). This system requires powerful computers to solve complex mathematical puzzles, consuming vast amounts of electricity in the process. According to research from the University of Cambridge, the Bitcoin network alone consumes more electricity annually than entire countries such as Argentina or the Netherlands.

To grasp the scale of this issue, consider a UN-backed study published in late 2023 in the scientific journal Earth’s Future. The research found that the global Bitcoin mining network consumed a staggering 173.42 terawatt-hours of electricity between 2020 and 2021. This level of energy use resulted in a carbon footprint equivalent to burning 84 billion pounds of coal or operating 190 natural gas power plants.

The environmental impact becomes even more concerning when considering how this electricity is generated. Many cryptocurrency mining operations are strategically located in regions with the cheapest electricity, often derived from fossil fuels such as coal. As a result, cryptocurrency mining has become a major contributor to air pollution and carbon emissions.

This environmental contradiction presents a fundamental challenge: how can a technology designed to create a more equitable and efficient financial system justify such a significant impact on the planet’s ecosystem?

The Alternative of Green Currencies

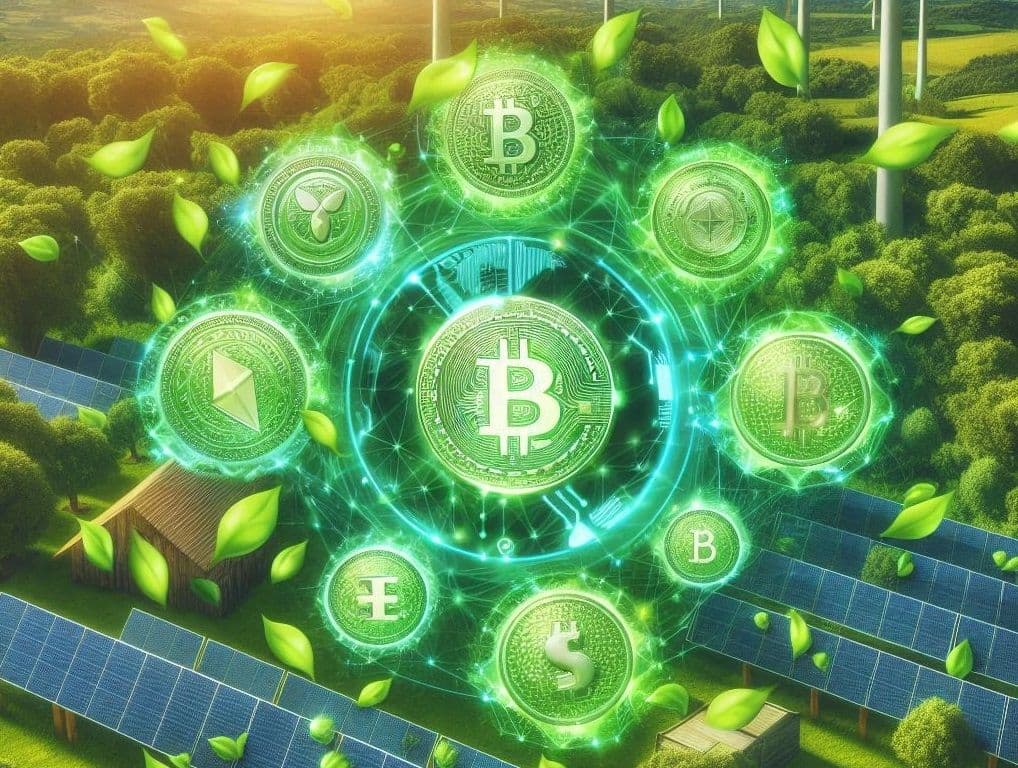

In response to these environmental concerns, a new generation of digital currencies has emerged: green cryptocurrencies. These innovative alternatives seek to retain the benefits of blockchain technology while drastically reducing or eliminating their environmental footprint.

Green cryptocurrencies operate under fundamentally different principles from their energy-intensive predecessors. Instead of relying on the resource-heavy Proof of Work mechanism, most green cryptocurrencies implement alternative consensus protocols such as Proof of Stake (PoS).

This system selects transaction validators based on the number of coins they hold and are willing to "stake" as collateral, eliminating the need for energy-intensive mining equipment. This approach reduces energy consumption by approximately 99.95% compared to traditional systems.

Beyond more efficient consensus mechanisms, many green cryptocurrencies incorporate additional environmentally friendly features.

Some allocate a percentage of transaction fees to environmental initiatives such as reforestation projects or renewable energy development. Others operate on carbon-negative blockchains, offsetting more emissions than they produce through strategic investments in sustainability.

Green Initiatives

As the crypto ecosystem moves towards greater sustainability, various initiatives have emerged to reduce the environmental impact of digital currencies.

A key example is Ethereum, which drastically reduced its energy consumption by transitioning from a Proof of Work (PoW) system to Proof of Stake (PoS).

Other cryptocurrencies, such as Cardano, Polkadot, Tezos, Stellar, and Algorand, have adopted this more efficient mechanism from their inception.

Meanwhile, Chia introduces an innovative approach with its Proof of Space and Time protocol, which requires significantly less energy than PoW.

These green cryptocurrencies not only optimise resource use but are also being adopted by companies and projects committed to sustainability, positioning themselves as a viable alternative in the digital finance sector.

The Challenges Ahead

Despite their promising environmental credentials, green cryptocurrencies face several significant challenges. The market dominance of Bitcoin and Ethereum, despite their environmental impact, represents a substantial obstacle for greener alternatives, which must overcome established network effects, liquidity, and brand recognition.

Technical trade-offs also pose a challenge. Some critics argue that alternative consensus mechanisms may introduce compromises in security or decentralisation. Proof of Stake systems, for example, could lead to wealth concentration among large coin holders, contradicting the democratising ethos of cryptocurrencies.

Regulatory uncertainty presents another major hurdle. The regulatory landscape for cryptocurrencies remains fragmented and unpredictable. While some jurisdictions may incentivise green cryptocurrencies through favourable policies, the lack of standardised environmental metrics complicates regulatory approaches.

A lack of education and awareness is also a barrier. Many cryptocurrency users remain unaware of the environmental impact of their digital transactions or the existence of greener alternatives. Bridging this knowledge gap will require coordinated educational efforts from both industry and environmental organisations.

Towards a Sustainable Economy

The future of green cryptocurrencies ultimately depends on a delicate balance between technological innovation, market forces, and environmental awareness. Financial institutions are increasingly incorporating environmental considerations into their cryptocurrency strategies, signalling a growing institutional preference for sustainable digital assets.

Consumer awareness of environmental issues is driving demand for sustainable alternatives across all sectors. As this consciousness extends to digital currencies, market pressures may accelerate the transition towards greener cryptocurrency options.

For green cryptocurrencies to realise their full potential, they must demonstrate that sustainability and functionality can coexist. Their success would prove that even in the fast-evolving world of digital finance, sustainability is not only feasible but essential for meaningful progress.